Gov Solar Panel Rebates, Solar Incentives & Loan in ACT 2025: Take Advantages Of Solar Subsidies to Modernize Your Home & Business

In This Article

ToggleThe ACT Government is championing sustainable and clean energy by introducing a suite of incentives and financial support programs designed to ease the upfront cost of rooftop solar and energy-efficient home appliances. To promote sustainable energy and to help ACT residents afford energy-efficient upgrades, the ACT Government & Federal Government provides a good amount of solar subsidies like solar panel rebates, incentives and interest-free loans.

These solar rebates, zero-interest loans, and other incentives help ACT residents for installation of rooftop solar panels, battery energy storage systems, solar hot water systems etc. and ultimately reduce their energy bills & carbon emissions.

Here’s a comprehensive overview of these solar panel rebates, initiatives, and loans including key features, benefits, eligibility etc. in ACT and additional opportunities of solar systems for both homeowners and businesses in Australia.

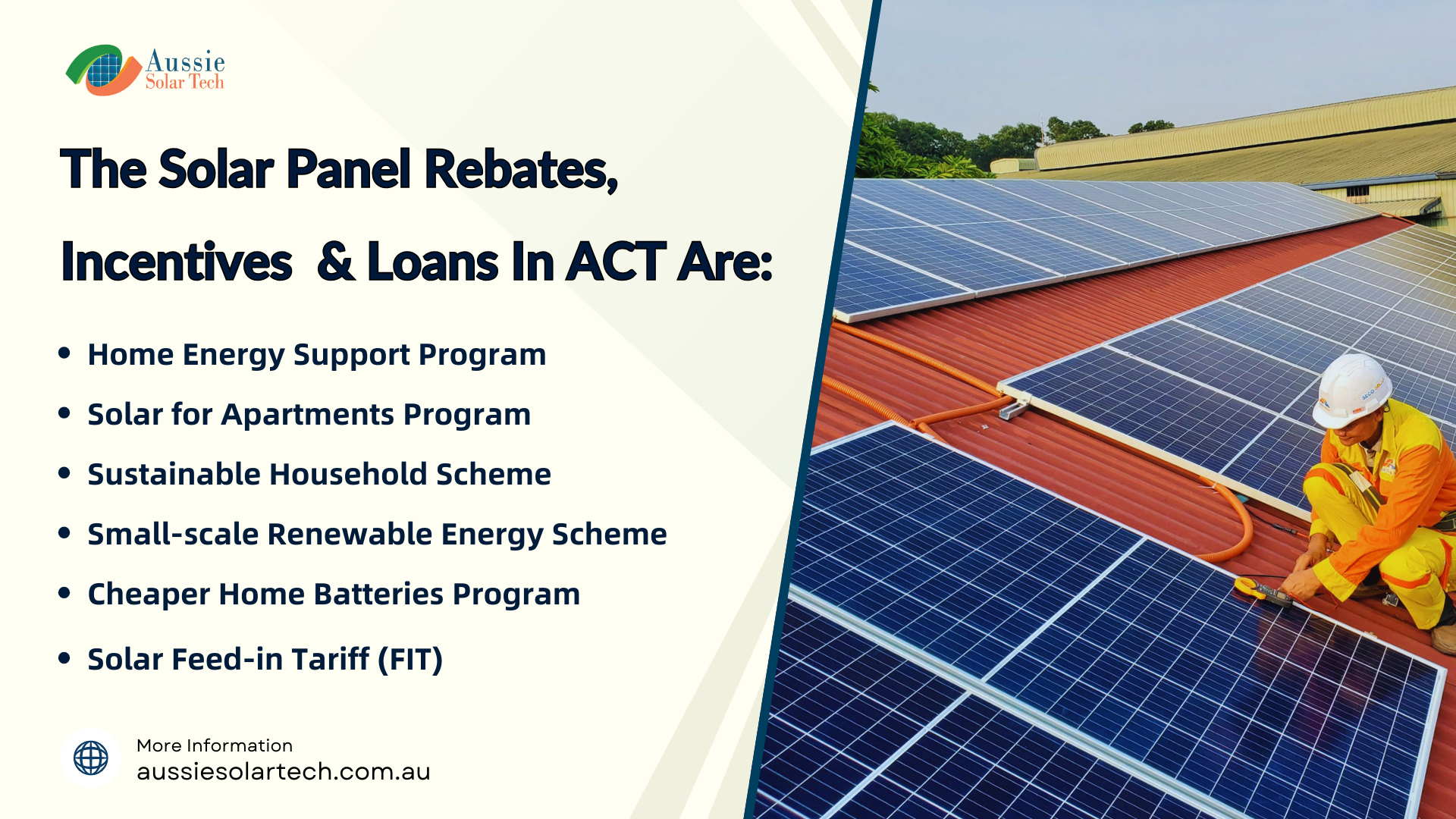

Overview of the solar panel rebates, incentives and loans program in ACT

The ACT government and Australian Federal Government is promoting sustainable energy, providing financial incentives to the residents for increasing renewable energy uses for both homeowners and businesses by offering a variety of solar incentives, rebates and loans which can help recoup some of the costs associated with the installation and purchase of said systems. The solar panel rebates, incentives and loans are:

- Home Energy Support Program

- Solar for Apartments Program

- Sustainable Household Scheme

- Small-scale Renewable Energy Scheme

- Solar Feed-in Tariff (FIT)

Home Energy Support Program – ACT Government

The Home Energy Support Program (HESP) in the Australian Capital Territory (ACT), offers rebates for homeowners to help with the upfront costs of installing energy-efficient products and rooftop solar, aiming to improve energy efficiency and reduce costs and increase the renewable uses through sustainable home upgrades.

Benefits of Home Energy Support Program

Eligible Homeowners can get rebates up to $5,000 :

- one rebate of 50% of the total cost of the supply and installation, up to $2,500, of rooftop solar

- and/or one rebate of 50% of the total cost of the supply and installation, up to $2,500, for:

- reverse cycle heating and cooling.

- hot water heat pumps and evacuated tube solar hot water systems.

- electric stove tops and ovens.

- ceiling insulation.

Important Info: ACT residents can combine the rebate with a zero-interest loan of up to $10,000 to help with the remaining costs. This means the total support available from the ACT Government is $15,000.

Eligibility of Home Energy Support Program

To be eligible for this rebate, you must:

- be a resident of the ACT

- hold an Australian Government Pensioner Concession Card, Department of Veterans’ Affairs Gold Card, or an Australian Government Health Care Card

- own and live in the home where the product will be installed

- have attended a free online Everyday Climate Choices workshop

- your property must be located within the ACT (including Hall, Tharwa and Oaks Estate but not Jervis Bay Territory).

- your property must be a standalone residence, or an individual unit titled property.

- unimproved value (UV) of your property must be at or below:

- $750,000 at the time of application in any year from 2022 for freestanding homes/units and dual occupancies. For unit titled freestanding properties this is based on the unit entitlement percentage.

- $300,000 in any year from 2022 for unit titled multi-story apartments.

Solar for Apartments Program – ACT Government

The Solar for Apartments Program is the ACT Government initiative designed to accelerate the adoption of solar power in multi-residential buildings. ACT Solar for apartments program aims to encourage the adoption of solar power in apartment complexes by making it more affordable to install solar panels. This can lead to reduced electricity bills for residents as the building generates its own clean energy. This Program is co-funded up to $3.6 million under the Community Solar Banks Initiative of the Australian Government and the ACT Government’s Sustainable Household Scheme.

Benefits of Solar for Apartments Program

- Eligible apartment complex owners corporations can receive a total up to $100,000 (inclusive of GST) in combined (Grant and Loan) funding by installing rooftop solar systems to reduce energy costs for all residents and renters.

- This funding is structured in a way that 50% that is $50,000 is provided as the commonwealth grant/rebate under the Community Solar Banks Initiative of Australian Government and remaining 50% that is $50,000 zero-interest green loan under ACT Government’s Sustainable Household Scheme. The zero-interest green loan of $50,000 is repayable over up to 10 years, making it accessible for multi-unit residential developments aiming to integrate rooftop solar systems.

- $50,000 zero-interest green loan is provided and managed by Brighte. Brighte Capital Pty Limited is the ACT Government financial partner for this Solar for Apartments Program.

Eligibility of Solar for Apartments Program

Owners corporations that are also known as body corporations that manage an eligible apartment complex within the geographical area of Australian Capital Territory, can apply for the Program.

- An Eligible Premise under the Program must be an apartment complex style dwelling that is part of a Class A unit plan as defined in the Unit Titles Act 2001. Each individual apartment complex style dwelling that is part of a Class A unit plan is identified as a distinct Premise.

- The Eligible Premise must be a completed development at the time of application. Ongoing developments or proposed developments are not eligible as part of the Program.

- The Eligible Premise must not have or have had a rooftop solar installation in place.

- The average unimproved value of a unit of the Eligible Premise must be at or below $300,000 in any year from 2022. To find the unimproved value for the Premise, the Participant may refer to unimproved values on the Access Canberra website. Average unimproved value of a unit at an Eligible Premise can be calculated by either the total unimproved value of the land divided by the number units at the Eligible Premise or the average of the unimproved values for each the units at the Eligible Premise.

- All Residents within the Eligible Premise must benefit from the proposed solar installation.

- The Eligible Premise must be geographically located within the ACT (including Hall, Tharwa and Oaks Estate but not Jervis Bay Territory).

- The Eligible Premise must be owned by the Eligible Participant and the Eligible Participant warrants it has full authority and approvals to install the Eligible Product/s, including strata approvals (if applicable). Where the Eligible Premise is not managed by the Eligible Participant, the Eligible Participant warrants it has the authority of the landlord, landowner or leaseholder (as the case may be) to have the works undertaken at the Eligible Premise.

- The owners corporation will also need to satisfy the requirements set by the loan provider Brighte, that they will be able to repay the loan component.

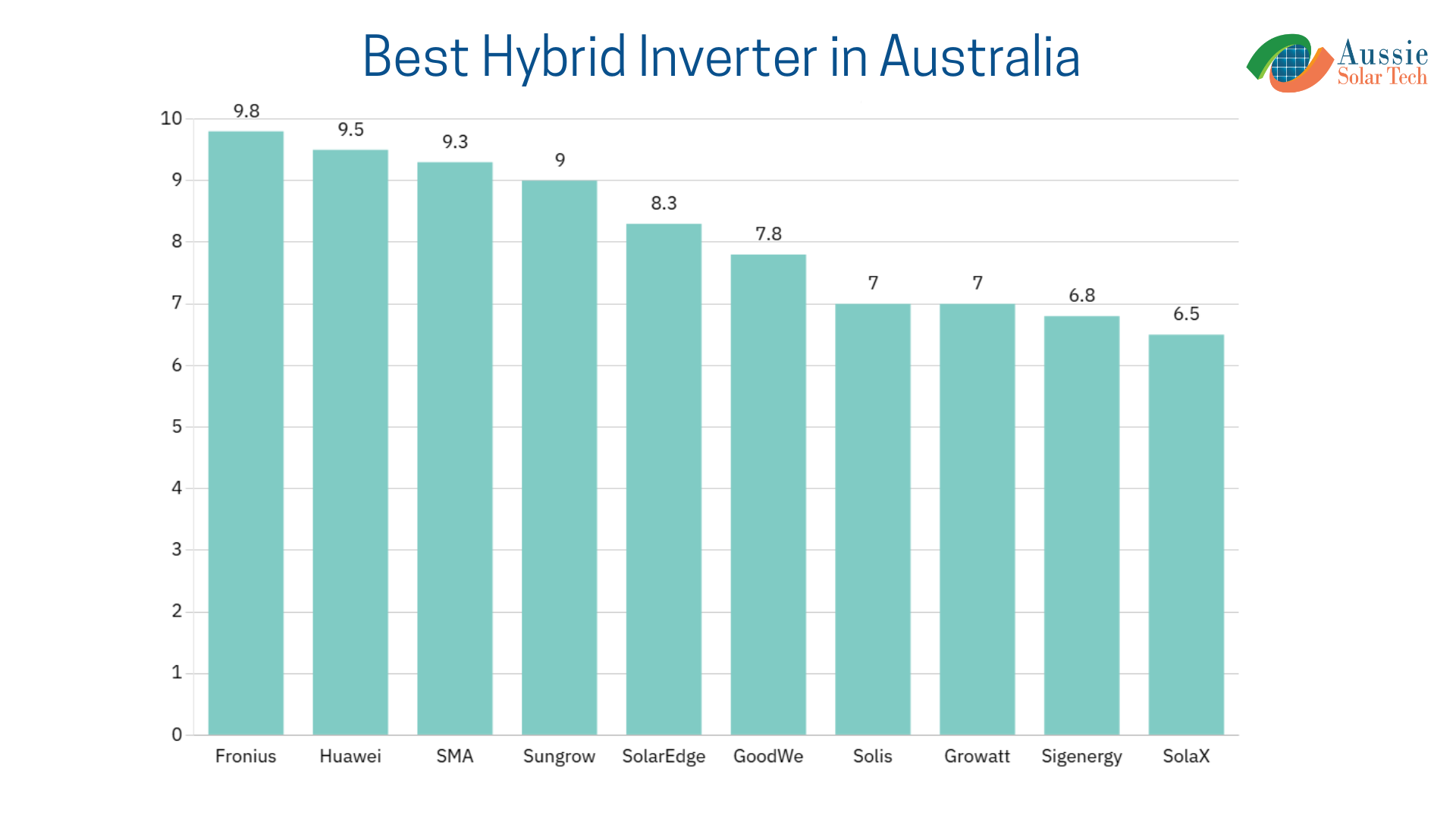

- The installed solar PV modules and inverters must be a part of the Clean Energy Council approved product list that is current at the time of installation.

Sustainable Household Scheme – Zero-Interest Loan

The Sustainable Household Scheme (SHS) in the Australian Capital Territory (ACT) offers eligible households zero-interest “Green Loan”, up to $15,000, to finance energy-efficient upgrades like installation of rooftop solar panel, battery storage, solar hot water systems, heat pump water heaters, EV chargers etc. and renewable energy technologies.

Purpose of this scheme is to help ACT residents help reduce energy use and costs, lower utility bills, help households live more comfortably, and transition to a more sustainable future through contribute to greenhouse gas emissions reductions and support development of the renewable energy industry in the ACT

Benefits of Sustainable Household Scheme

- ACT residents can get a green loan from $2,000 to $15,000.

- This loan is zero interest for up to 10 years period and no upfront costs or fees.

- You can repay the loan over up to 10 years.

Eligibility of Sustainable Household Scheme

- ACT residents who own the property in which the installation is to occur; or living with the person who owns the property in which the installation is to occur will be able to apply for interest free loans for the purchase of products to improve household sustainability and reduce emissions.

- Property should be a standalone residence or a unit titled property. Each individual unit titled

- Property within a unit plan is defined as a distinct eligible property.

- Property should be geographically located within the ACT (including Hall, Tharwa, and Oaks Estate but not Jervis Bay Territory).

- The $15,000 can also be spread across more than one property, as long as each property meets the unimproved value thresholds.

- The Unimproved Value (UV) of the property must be at or below $450,000 in any year from 2022.

- The installed solar PV modules, inverters and other eligible products must be a part of the Clean Energy Council approved product list that is current at the time of installation.

- The homeowner needs to satisfy the requirements set by the loan provider Brighte, that they will be able to repay the loan component.

Eligible Products Under Sustainable Household Scheme

Zero-Interest green loan can be avail for the installation and purchase costs for below products:

- rooftop solar panels

- household battery storage systems

- electric heating and cooling systems

- hot water heat pumps

- electric stove tops

- electric vehicles

- electric vehicle charging infrastructure

- ceiling insulation

You can apply for a loan of $10,000 under this scheme and a subsidy of $5,000 under another program, such as the Home Energy Support Program. This means the total support available from the ACT Government is $15,000.

Small-scale Renewable Energy Scheme (SRES) – Federal STC Rebate

The Small-scale Renewable Energy Scheme is an Australian Federal Government incentive program under the Renewable Energy Target (RET) scheme that encourages investment in small-scale renewable energy systems and administered by Clean Energy Regulator, Australia.

Installing small-scale renewable energy systems like rooftop solar, solar water heaters and air source heat pumps etc. allows the creation of small-scale technology certificates (STCs) with a value that is called STC rebate that can be redeemed by selling or assigning them to slash the eligible system installation cost. When you install an eligible renewable energy system, you earn a certain number of STCs.

Benefits of Small-scale Renewable Energy Scheme (SRES)

- Under this scheme installing an eligible system allows the creation of small-scale technology certificates (STCs) with a value that is STC rebate.

- STC rebates lower your installation and purchase cost of small-scale renewable energy systems like rooftop solar, solar water heaters and air source heat pumps etc.

Example: A 6.6kW solar panel system installed in Canberra (Zone 3) generates approximately 9.1 MWh per year. Considering the current deeming period (remaining years until 2030), this solar panel system would produce around = Postcode Zone Rating: 1.382 × Deeming Period Years: 6 × System Size in kW: 6.6 = 54 STCs. Each STC price is now $40, So the total STC rebate would be: 54 STCs × $40 = $2,160 for 6.6kW system in Canberra. - This scheme helps you to lower your energy bills, reduce your carbon footprint.

- Depending on the type of system you install, you may be able to sell some of the electricity it generates back to the grid. This is a feed-in tariff.

- Renewable energy systems in a home are often considered more desirable by home buyers and the value of the property increases for upgradation of small-scale renewable systems like rooftop solar, solar water heaters and air source heat pumps as these systems have multi purpose benefits.

Eligibility of Small-scale Renewable Energy Scheme (SRES)

- Australian homeowners and small businesses who install a small-scale renewable energy system (solar, wind or hydro), or hot water system, may be able to receive a benefit under this scheme towards the purchase cost.

- Installed system should be small-scale. Systems with higher capacity than the small scale limit then will be classified as power stations. Power stations can be accredited under the Large-scale Renewable Energy Target and may be eligible for large-scale generation certificates.

- Small-scale systems capacity are following:

- Solar Photovoltaic (PV): System capacity: no more than 100 kW. Annual electricity output: less than 250 MWh.

- Wind Turbines: System capacity: no more than 10 kW. Annual electricity output: less than 25 MWh.

- Hydro Systems: System capacity: no more than 6.4 kW. Annual electricity output: less than 25 MWh.

- Solar Water Heaters: System capacity: up to 700 L. Models with a capacity over 700 L need further documentation to be eligible for STCs.

- Air Source Heat Pump: System capacity: no more than 425 L.

- Your system must be installed by a Solar Accreditation Australia accredited installer or systems must be installed by a Clean Energy Council (CEC) accredited installer . The solar panels and inverter must be on the lists of Clean Energy Council approved modules and inverters.

- Battery storage systems are not eligible under the scheme.

- Systems can’t be pre-approved. Applicants should check that their system will be eligible prior to installation and use approved products and installers. Eligibility is determined after the system is installed and an application is received.

Cheaper Home Batteries Program

Australian federal government announced Cheaper Home Batteries Program to make battery storage more affordable than ever, providing rebates of up to 30% on the upfront cost of installing eligible small-scale solar battery systems.

The rebate amount will be based on the solar battery’s usable capacity and will gradually decrease until 2030, as the rebate will be administered through an expansion of the running Small-scale Renewable Energy Scheme (SRES), which already proving STC rebates for solar panels installation all over the country.

Cheaper Home Batteries Program is a $2.3 billion national initiative, aims to reduce the upfront cost of installing a solar battery system at home or in small businesses and maximising the renewable energy uses.

Key Info: Cheaper Home Batteries Program

- Start: The rebate applies to solar battery systems installed from 1 July 2025. Solar battery systems installed before 1 July 2025 will only be eligible if not activated until after the program begins.

- Max Rebate:: Up to 30% off the cost of an eligible solar battery system. In 2025, rebate amount is around $372 per kWh of usable capacity of the solar battery system in 2025.

- Equipment and installers: Solar battery and inverter should be CEC approved and should be installed by a Solar Accreditation Australia (SAA) accredited installer.

- Program ending: The rebate will be available until 2030. The rebate amount will decrease over time, so install now and get maximum rebate facilities.

- Agitational benefits : It is possible to combine state and territory solar battery incentives with the federal solar battery rebate, depending on the eligibility criteria of each program.

Eligibility of Cheaper Home Batteries Program

Eligibility is still subject to amending the Renewable Energy (Electricity) Regulations 2001 and requirements may change. The proposed eligibility for the program includes:

- A single solar battery system with a nominal (total) capacity of 5 kWh to 100 kWh will be eligible.

- The solar battery system’s usable capacity will be used to calculate the number of STCs it will be eligible for STCs can only be claimed for the first 50 kWh of usable capacity.

- The solar battery will need to be installed with a new or existing solar photovoltaic (PV) system.

- The solar battery system is considered ‘installed’ when a certificate of electrical compliance or equivalent is signed, which confirms that the system complies with relevant state and territory electrical safety regulations.

Benefits of Cheaper Home Batteries Program

- Up to 30% of the total costs of purchase & installation of solar battery systems, valued at around $372 per kWh, assuming $40 per STC the estimated maximum amount is $18,500 in 2025.

- For a 10 kWh battery, the estimated incentive will be $3,720 and for a 13.5 kWh (e.g. Tesla Powerwall 2 & Tesla Powerwall 3), the estimated incentive will be $4,500 in 2025.

- The rebate amount will decrease over time as the estimated STC factor in 2025 is 9.3, in 2026 is 8.4, in 2027 is 7.4, in 2028 is 6.5, in 2029 is 5.6, and in 2030 is 4.7 for per kWh usable solar battery capacity. So install solar battery earliest and get maximum rebate facilities.

Solar Feed-in Tariff (FIT) – ACT Government

Solar power systems use solar panels also known as photovoltaic (PV) panels. The panels usually last for about 25 years and they turn the sun’s energy into electricity. Solar systems are generally two types:

- connected to the electricity network – this is called the grid solar system.

- separate from the electricity network – this is called off-grid solar system.

When you put in a solar energy system that is connected to the grid or electricity network, you might get paid for the electricity you put back into it.

A solar feed-in tariff is an amount that is paid to you for putting excess electricity generated by your small-scale solar energy system into the grid. In the Australian Capital Territory, gross feed-in tariff system is applied where your retailer credits you for all the electricity your solar system feeds into the grid, and then charges you separately for all the electricity you use. The feed-in tariff rates are typically calculated and paid out on a per kilowatt-hour (kWh) basis, The amount paid can vary depending on the retailer and your existing plan.

In the Australian Capital Territory (ACT), the feed-in tariff for solar energy typically ranges from 7 to 12 cents per kilowatt-hour (kWh) in 2025, depending on the retailer and your existing plan.

Tax Benefits Solar Power System in Australia

In addition to the solar rebates & incentives, solar systems are classified as depreciable over time as a capital asset, so solar owners in Australia get tax benefits, making solar investment even more attractive. Homeowners can claim depreciation.

The Australian Taxation Office (ATO) determines the effective life, which is the number of years that the asset is expected to be used or have a useful life. Generally, the effective life of a solar system is 20 years. In Australia, solar system diminishing value depreciation method rate is 10% and prime cost depreciation method rate is 5%.

Businesses can claim input tax credits for solar purchases. According to the Instant Asset Write-Off Scheme or under small business tax concessions, eligible businesses can claim deductions for the full cost of solar system installations within the financial year.

Additional Benefits of Rooftop Solar & Energy-Efficient Appliances in Australia

- Significant Electricity Bill Reduction: With high-quality rooftop solar panel solutions and energy-efficient appliances, households can reduce their electricity bills by more than 70%.

- Environmental Impact: Solar energy systems play a crucial role in reducing carbon emissions and promoting the widespread use of renewable energy, contributing to a cleaner and greener earth.

- Property Value & Beauty Increase: Energy-efficient upgrades like rooftop solar panels systems not only lower emissions but also enhance buyer appeal and higher the property value and beauty.

Perspectives on solar rebates and incentives in ACT

Supportive Perspective:

Proponents of these initiatives commend the comprehensive support provided by both the ACT and Federal Governments. They emphasize that the array of incentives, from upfront rebates and zero-interest loans to significant tax benefits, helps lower energy bills, boost property values & beauty, and foster a sustainable future by reducing reliance on fossil fuels.

Critical Perspective:

Some critics highlight that despite generous incentives, the initial costs can still be challenging for lower-income households, particularly in apartments or rental properties. They also caution against the potential market distortions that might arise if the solar industry becomes overly dependent on subsidies. Nonetheless, many agree that increased adoption of solar power and energy-efficient technologies will drive down costs over time as the market matures.

Industry and Community Impact:

Industry experts believe that these forward-thinking initiatives will stimulate technological innovation, create new jobs, and make solar energy more affordable in the long run. Community leaders underscore the need for a balanced approach that benefits both early adopters and the broader public, ensuring that the transition to renewable energy is inclusive and sustainable.

Conclusion

The ACT Government, together with Federal Government support, is creating a unique opportunity for homeowners and businesses to invest in solar installation and energy-efficient upgrades. Solar rebates up to $5,000 under the Home Energy Support Program, significant federal incentives via the Small-Scale Renewable Energy Scheme up to 40% of solar systems installation costs, up to $100,000 (inclusive of GST) in combined (Grant and Loan) funding by Solar for Apartments Program, and zero-interest green loans up to $15,000 through the Sustainable Household Scheme are making the rooftop solar panel systems installation and other solar power systems installation more accessible and cost-effective.

In addition to reducing electricity bills by over 70%, solar energy systems provide tax benefits, boost property value & beauty, and allow solar owners to earn money by exporting surplus electricity through feed-in tarrif. This multi-faceted approach is a great opportunity to save money, drive sustainability, and promote a clean and green earth.

Established in 2016, Aussie Solar Tech is a Clean Energy Council (CEC) Approved Solar Retailer and Solar Installer. We are offering customized solar systems with NETCC solar panels, inverters, and batteries for residential, commercial and industrial clients across the ACT, NSW, VIC, and Queensland. Check your eligibility for the Government’s solar rebates, incentives and interest free green loan. Share with us your ideas and requirements. Contact us and get a solar quote free today!

Shah Tarek is a Solar Energy Consultant with 10 years experience in solar system design and solar consultancy field at Australia. He is now a Director, Operation & Consultancy Division at Aussie Solar Tech, a leading Australian solar retailer and installer. Here he is writing informative and engaging solar content that educates the community on the benefits of solar power. His work supports Aussie Solar Tech’s mission to promote sustainable energy solutions and foster a greener future for Australia.

Recent Posts