Federal STC Rebate: Your Ultimate Guide to Solar Incentives for Rooftop Solar and Energy-Efficient Home Appliances Installation in Australia 2025

In This Article

ToggleAre you looking to reduce the cost of your rooftop solar panel installation, upgrading your property with energy-efficient home appliances (solar hot water systems, heat pump water heaters etc.) and maximize your renewable energy investment? The STC Rebate (Small-scale Technology Certificates Rebate) is a game-changing Federal Government solar incentive in Australia that makes it easier than ever to embrace solar power. In this comprehensive guide, we’ll dive into what is the stc rebate, how the stc rebate works, solar zones in Australia, stc rebate calculation, stc rebate benefits, and everything you need to know about Small-scale Technology Certificates rebate in Australia in 2025.

What is the STC Rebate?

The STC Rebate is an integral aspect of Australia’s Small-scale Renewable Energy Scheme (SRES). This Australian Federal Government initiative enables homeowners and small businesses to earn Small-scale Technology Certificates (STCs) by installing eligible renewable energy systems, such as solar panels. These tradable certificates function as a solar rebate by lowering the overall cost of installing your solar panels.

- Key Points:

- STCs as Tradable Credits: Each STC (Small-scale Technology Certificate) signifies a specific amount of renewable energy produced by your solar panel system, enabling you to sell these credits on the market.

- Lower Upfront Costs: The income generated from STC (Small-scale Technology Certificate) sales helps reduce installation costs, making solar power more accessible..

- Eligibility: The rebate applies to the solar systems up to 100 kW and Annual electricity output: less than 250 MWh, covering a broad range of residential and small commercial projects. Solar hot water systems-system capacity: up to 700 L. Heat pump water heaters-system capacity: no more than 425 L.

How Does the STC Rebate Work?

The STC Rebate operates on a certificate-based trading system. Here’s how it works:

- When a homeowner or business installs an eligible solar power system, a certain number of Small-scale Technology Certificates (STCs) are generated.

- The number of STCs issued depends on several factors:

- System Size: Larger systems produce more energy and therefore qualify for more STCs.

- Geographic Location: Sunnier areas receive more STCs as they generate higher solar energy output.

- Deeming Period: The government reduces the number of STCs issued each year until the program ends in 2030.

- These STCs can then be sold to electricity retailers, who are required to purchase them to meet their renewable energy targets. This effectively provides a solar Rebatet on the upfront cost of the solar system.

By understanding this system, homeowners and businesses can maximize their savings by selecting the right solar system size and installation location to generate the most STCs (Small-scale Technology Certificates) possible.

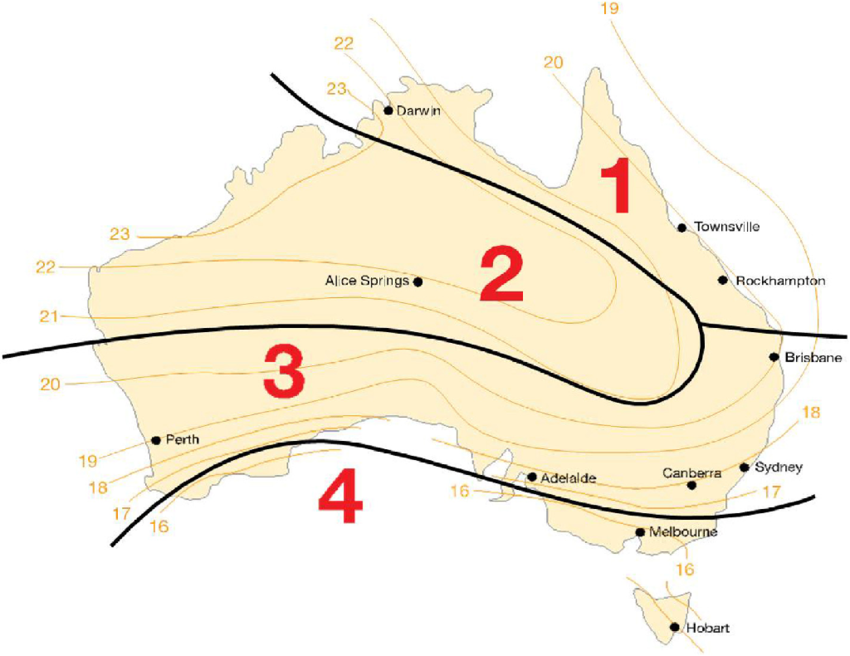

Understanding Solar Zones in Australia

Australia is divided into Four Solar Zones based on solar radiation intensity, which determine the number of STCs (Small-scale Technology Certificates) that can be claimed for a solar panel system installation. These zones are based on the amount of solar radiation (PV) received in different regions:

- Zone 1 (Most Sunlight): Includes regions in northern Australia, such as Darwin and parts of Queensland. Solar systems in this zone generate the most STCs due to higher solar radiation levels.

- Zone 2 (Moderate) : Covers areas like Brisbane and Perth, where solar output is still high, but slightly lower than Zone 1.

- Zone 3 (Average Sunlight) : Includes ACT, Sydney, Adelaide, and Melbourne, where solar radiation is moderate.

- Zone 4 (Least Sunlight): Covers southern parts of Australia, such as Tasmania, where the number of STCs (Small-scale Technology Certificates) generated is the lowest due to reduced sunlight.

The map of Australia divided into four zones based on solar radiation intensity:

Photo Credit: ResearchGate Article

Find Out Your Solar Zone Here

How to Calculate STCs Rebate?

Small-Scale Technology Certificates (STCs) Calculator requires only three inputs:

- System Size (kW): The total capacity of your solar panel system.

- Solar Zone: The geographical zone where your solar system is installed, as different regions in Australia receive varying levels of sunlight.

- Installation Year: The year you plan to install your solar panel system, as the Renewable Energy Target (RET) operates on a declining scale until 2030.

The calculator instantly provides:

- Total STCs: The number of certificates your system is eligible for.

- STC Incentive: The monetary value of these STCs, calculated at $40 per certificate if you install your solar panel install in 2025

Small-Scale Technology Certificates (STCs) Calculation and STC Rebates Calculation Formula

The formula to calculate the number of Small-scale Technology Certificates (STCs) generated by a solar panel system is relatively straightforward. It involves considering the system’s size, location, solar zone rating, and installation date.

The amount of STCs created from a solar panel system will be based on three Values:

- The total power capacity of the solar panel system is measured in kilowatts (kW).

- The rating of the solar zone where the solar panels are installed.

- The number of years the solar panel system will be producing for, before the scheme is phased out in 2030.

The amount of STCs calculation formula is bellow: Number of STCs = Postcode Zone Rating × Deeming Period Years × System Size in kW

The amount of STC Rebates calculation formula is bellow: Amount Of STC Rebates = STCs × Price of each STC

Example Calculation For Finding STCs and STC Rebates: A 6.6kW solar panel system installed in Canberra (Zone 3) generates approximately 9.1 MWh per year. Considering the current deeming period (remaining years until 2030), this solar panel system would produce around = Postcode Zone Rating: 1.382 × Deeming Period Years: 6 × System Size in kW: 6.6 = 54 STCs. Each STC price is now $40, So the total STC rebate would be: 54 STCs × $40 = $2,160 for 6.6kW system in Canberra.

The Table of Potential Solar Packages & STC Rebates That You Could Take Advantage In the Different Solar Zones In Australia:

Choosing a solar system based on your zone is crucial, as it directly impacts the rebate amount. STC’s (Small-scale Technology Certificates) Solar rebate for popular solar panel installation packaged in 2025 and Government Deeming Period 2030 .

| Solar Zone 1 (Most Sunlight) Solar Zone factor of 1.622 | |||

| System size | Amount of STC’s | STC Price | STC Incentive |

| 6.6 kW | 64 | $40 | $2,560 |

| 10.56 kW | 102 | $40 | $4,080 |

| 13.2 kW | 128 | $40 | $5,120 |

| 19.3 kW | 187 | $40 | $7,480 |

| Solar Zone 2 (Moderate) Solar Zone factor of 1.536 | |||

| System size | Amount of STC’s | STC Price | STC Incentive |

| 6.6 kW | 60 | $40 | $2,400 |

| 10.56 kW | 97 | $40 | $3,880 |

| 13.2 kW | 121 | $40 | $4,840 |

| 19.3 kW | 177 | $40 | $7,080 |

| Solar Zone 3 (Average Sunlight) Solar Zone factor of 1.382 | |||

| System size | Amount of STC’s | STC Price | STC Incentive |

| 6.6 kW | 54 | $40 | $2,160 |

| 10.56 kW | 87 | $40 | $3,480 |

| 13.2 kW | 109 | $40 | $4,360 |

| 19.3 kW | 160 | $40 | $6,400 |

| Solar Zone 4 (Least Sunlight) Solar Zone factor of 1.185 | |||

| System size | Amount of STC’s | STC Price | STC Incentive |

| 6.6 kW | 46 | $40 | $1,840 |

| 10.56 kW | 75 | $40 | $3,000 |

| 13.2 kW | 93 | $40 | $3,720 |

| 19.3 kW | 137 | $40 | $5,480 |

How Much Can You Save With The STC Rebate In Australia In 2025?

The savings from the STC Rebate can vary significantly depending on several factors. On average:

-

- A 6.6 kW solar system may generate around 46 – 64 STCs, leading to potential savings of $1,840 – $2,560.

- A 10.56 kW solar system may generate around 75 – 102 STCs, leading to potential savings of $3,000 – $4,080

- A 13.2 kW solar system may generate around 93 – 128 STCs, leading to potential savings of $3,720 – $5,120

- A 19.3 kW solar system may generate around 137 – 187 STCs, leading to potential savings of $5,480 – $7,480

- The exact savings depend on the STC market price, which fluctuates based on supply and demand.

- The number of STCs awarded depends on your solar zone—installations in Zone 1 receive more STCs than those in Zone 4 due to higher solar energy output.

In regions with higher solar energy output, the rebate can be even greater. Those considering solar energy systems installation should consult a reputable installer to get an accurate rebate estimate.

How to Get Started with STC Rebate in Australia

If you’re considering solar panel installation in Australia, follow these steps to take full advantage of the STC Rebate in 2025. The application process for the STC (Small-scale Technology Certificate) Rebate involves several key steps to ensure you receive the financial benefit from solar system installaion. Here’s what you need to do:

1. Check Your Eligibility

You have to confirm that your solar energy system meets the eligibility criteria under the Small-scale Renewable Energy Scheme (SRES). Your system must:

- Be an eligible small-scale renewable energy system (e.g., solar PV, wind, or hydro).

- Be installed by a Clean Energy Council (CEC) accredited professional.

- Meet the necessary compliance and safety standards.

2. Calculate the Number of STCs You Can Claim

The number of STCs you receive depends on:

- The size of your solar system (measured in kW).

- Your location (higher solar exposure areas generate more STCs).

- The number of years remaining until the STC scheme phases out. Use an online STC calculator provided by the Clean Energy Regulator to estimate your rebate.

3. Choose Your Method of Claiming STCs

There are two primary ways to claim your STCs:

- Upfront Discount Through Your Installer: Most homeowners opt for this method, where the solar retailer or installer offers an immediate rebate by reducing the installation cost in exchange for your STCs.

- Self-Registration and Selling STCs: If you prefer, you can create an account with the Renewable Energy Certificate (REC) Registry, register your STCs, and sell them independently to traders or energy retailers.

4. Gather Required Documentation

To apply, you’ll need:

- Proof of purchase (invoice and contract).

- System details, including make and model.

- Installation certificate from a CEC-accredited installer.

- Compliance documents as required by your state or territory.

5. Submit Your Application

- If using an installer’s rebate option, they will handle the paperwork for you.

- If self-registering, create an account on the REC Registry, submit the required documents, and follow the verification process.

6. Receive Your Rebate

- If you opted for the upfront discount, your installation cost will be reduced accordingly.

- If you sell your STCs independently, you will receive payments based on the current market value of STCs.

Benefits of the STC Rebate for Solar Panel Installation In 2025

Investing in solar energy with the help of the STC Rebate comes with a host of benefits:

- Reduced Installation Costs: The STC rebate lowers the initial cost of installing a solar panel system. Homeowners and businesses can enjoy savings of thousands of dollars on eligible systems. The rebate is applied instantly as a discount when purchasing a solar system through an accredited installer.

- Makes Solar Energy More Affordable: By reducing the upfront investment, more households and businesses can afford to switch to solar power. Help homeowners start saving on electricity bills sooner.

- Enhanced Property Value: Solar panel installations not only lower energy bills but also increase your property’s market value.

- Environmental Impact: Adopting renewable energy reduces your carbon footprint, Contributes to Australia’s renewable energy targets and reduces reliance on fossil fuels, 100% renewable energy future. Provides an incentive for more people to transition to clean, renewable energy.Reduces carbon emissions by replacing fossil fuel-based electricity with clean solar energy. Helps combat climate change while promoting eco-friendly energy solutions.

- Energy Independence: Investing in solar power provides long-term savings and energy independence from traditional utility companies.

- Long-Term Electricity Savings: Installing a solar system with the STC rebate leads to lower electricity bills over time. Solar panels generate free energy from sunlight, reducing your dependence on grid power.

- Nationwide Availability: The STC rebate is available across all states and territories in Australia. Regardless of location, homeowners and businesses can benefit from the program.

Why Choose Solar Incentives Like the STC Rebate In 2025?

The STC Rebate in 2025 is one of many solar incentives designed to promote clean energy adoption. Here’s why it’s an excellent option:

- Affordability: Solar incentives like the STC Rebate make solar power accessible even if the initial cost seems high.

- Government Support: With backing from government initiatives like SRES, homeowners and businesses are encouraged to transition to renewable energy.

- Comprehensive Savings: Not only do you save on electricity bills, but the financial returns from selling STCs can substantially reduce your overall investment.

- Sustainability: By reducing reliance on fossil fuels, you contribute to a greener future and a healthier environment.

Comparison of State Solar Rebates and Incentives Programs

You can review this table to learn and compare additional solar energy rebates and incentive programs.

| State | Solar Subsidy, Rebates, Incentives & Green Loans |

| Australian Capital Territory (ACT) | The ACT Government highly promoting sustainable & clean energy and providing $5000(2500*2) rebates as upfront costs of installing rooftop solar and energy-efficient home appliances like solar hot water systems, heat pump water heaters etc. under Home Energy Support Program. At ACT, You can get zero interest “Green Loan” up to $15,000 for upgrading your property with rooftop solar and energy-efficient home appliances such as battery storage, solar hot water systems, heat pump water heaters, EV chargers etc. under the ACT Government’s Sustainable Household Scheme. You have up to 10 years to repay it. Apartment complex owner’s corporations in ACT can get up to $50,000 as Commonwealth grant/rebate and up to $50,000 as zero-interest green loan for installing rooftop solar systems under the Solar Banks Initiative of the Commonwealth Government and the ACT Government’s Sustainable Household Scheme which is managed by Solar for Apartments Program. For a green loan of $50,000, the owner’s corporation has up to 10 years to repay it. |

| New South Wales (NSW) | The NSW Government provides 50% of the total cost up to $150,000 of installing solar photovoltaic (PV) systems in the Apartment Complex under the Solar for Apartment Residents (SoAR) Grant Program. This initiative benefits residents, including renters, by helping to lower energy bills and reduce greenhouse gas emissions. Property owners in NSW can get rebates up to $2,400 for upgrading your home or business with a battery energy storage system under NSW Government’s Peak Demand Reduction Scheme (PDRS). This Scheme aims to reduce peak electricity demand in NSW. It started in 2022 and will end in 2050. NSW residents can receive an incentive of $120 – $400 for connecting battery energy storage systems to Virtual Power Plant (VPP) under the Energy Savings Scheme (ESS) and it can be claimed twice over a 3-year period. A VPP allows you to sell some of the excess stored energy in your battery when other people on the grid need it most. This will help reduce NSW’s emissions by 70% by 2035 and achieve net zero by 2050. At NSW, You can receive an incentive of $190 – $670 for switching to a new energy-efficient heat pump water heaters (HPWH) in your home or business under the Energy Savings Scheme (ESS) that are more efficient and reliable and save your energy bills in the long term by using less energy. These systems will reduce your emissions and help to achieve NSW reach net zero by 2050. Home and Business owners can get a discount of $4,950 on a Tesla Powerwall 2 under Smart Distributed Batteries Project as part of the first NSW Government-funded Virtual Power Plant (VPP) in the South Coast. |

| Victoria | The Small-scale Renewable Energy Scheme (SRES) provides an incentive of approximately $1,840 – $2,160 for a 6.6kW solar system, which is typically included in the advertised prices. Additionally, the Victorian Solar Panel Rebate offers homeowners up to $1,400 towards the cost of their solar system, alongside the national stc rebate. Zero-interest loan up to $8,800 available in Victoria for solar battery installation. Feed-in Tariff, allowing residents to receive payments for surplus solar energy exported to the grid. However, the Essential Services Commission has proposed a reduction in the feed-in tariff from 3.3 cents to 0.04 cents per kilowatt-hour for the 2025-26 financial year, which could impact households with rooftop solar systems by eliminating electricity bill credits. A $1,000 rebate for hot water heat pumps or electric boosted solar hot water and an additional rebate of around $600 to replace a gas or electric hot water heater with a heat pump is available to most households. |

| Queensland | The Federal Government Rebates that is stc rebate under the Small-scale Renewable Energy Scheme (SRES) provides an incentive approximately $2,050 off on 6.6kW solar panel (PV) system installation and provides payments for surplus energy exported to the grid, helping to accelerate the payback period for solar investments. Feed-in Tariff, allowing residents to receive payments for surplus solar energy exported to the grid. |

| Tasmania | The Federal Government Rebate under the Small-scale Renewable Energy Scheme (SRES) provides an incentive of around $1,748 for a 6.6kW solar system, Additionally, Tasmania offers a Feed-in Tariff, allowing residents to receive payments for any surplus energy they export to the grid. Under the Energy Saver Loan Scheme, zero interest loans of up to $10,000 are available to households and small businesses for upgrading the property with rooftop solar, solar batteries, battery storage energy system, reverse cycle air conditioners, insulation, induction stoves and heat pump hot water systems. |

| South Australia | The Federal Government Rebate through the Small-scale Renewable Energy Scheme (SRES) provides an incentive of approximately $2,050 for a 6.6kW solar system, Additionally, South Australia offers a Feed-in Tariff, allowing residents to receive payments for excess solar energy exported to the grid. The Retailer Energy Productivity Scheme (REPS) provides an incentive for installing heat pump hot water systems where households without gas, the incentive amount is approximately $930 and households with gas connections, the incentive amount is approximately $270. If you’re a pensioner, Health Care Card holder, or otherwise a member of a REPS Priority Group, it increases by around $124. The incentive goes to installers and they decide how to facilitate the customers. The Adelaide City Council also provides a local incentive, offering up to 20% off the cost of a solar system and subsidies for electric vehicle (EV) chargers in Adelaide City and North Adelaide. |

| Western Australia | The Federal Government Rebate that is stc rebate under the Small-scale Renewable Energy Scheme (SRES) offers an incentive of around $2,050 for a 6.6kW solar system. Feed-in Tariff allowing Western Australia residents to receive payments for surplus energy they export to the grid. |

| Northern Territory | The Federal Government Rebate through the Small-scale Renewable Energy Scheme (SRES) offers a rebate of approximately $2,280 for a 6.6kW solar system. Feed-in Tariff allowing Northern Territory residents to receive payments for any excess solar energy exported to the grid. Home and Business Battery Scheme in the Northern Territory offers a grant of $400 per kilowatt-hour, up to a maximum grant of $12,000 on eligible battery systems. For example, with 13.5kWh capacity, a Tesla Powerwall would be eligible for $5,400. More information here. Electric Vehicles (EVs) Grant: Free registration, stamp duty exemption up to $1,500 for vehicles valued up to $50,000 (3% stamp duty on the amount over). EV Chargers Grant: The Northern Territory (NT) government is offering grants for the installation of EV chargers of up to $1,000 for households and $2,500 for businesses. |

Additional Benefits of Solar System In Australia

Apart from the STC Rebate, several other government energy rebates and incentives are available in Australia to support renewable energy adoption. There are also Feed-in Tariffs and Tax Benefits available for the Australian residents for solar panel installation in the property.

Feed-in Tariffs (FiTs): Feed-in Tariffs (FiTs) are payments made to homeowners or businesses for the excess solar power they export back to the grid. The FiT rate varies by state and electricity provider, but it typically ranges between 3 to 12 cents per kWh. Key aspects of FiTs include:

- State Regulations: FiT rates and policies vary across Australian states, so it’s important to consult your local government and energy provider.

- Retailer Offers: Some energy retailers provide competitive FiT rates or additional incentives for customers with solar panel systems.

- Maximizing FiT Benefits:To maximize FiT benefits, homeowners can optimize energy usage by running appliances during peak solar production and exporting excess energy when rates are higher.

FiTs are an excellent way to significantly reduce electricity bills over time and maximize the long-term financial benefits of investing in a solar energy system.

Tax Benefits For Solar System Installation: Solar systems are depreciable over time as a capital asset, so solar owners in Australia get tax benefits, making solar investment even more attractive. Homeowners can claim depreciation. The Australian Taxation Office (ATO) determines the effective life, which is the number of years that the asset is expected to be used or have a useful life. Generally, the effective life of a solar system is 20 years. In Australia, solar system diminishing value depreciation method rate is 10% and prime cost depreciation method rate is 5%.

Businesses can claim input tax credits for solar purchases. According to the Instant Asset Write-Off Scheme or under small business tax concessions, eligible businesses can claim deductions for the full cost of solar system installations within the financial year.

Additionally, earning from surplus energy sales through feed-in tariffs is taxable, but deductions can offset this.

Frequently Asked Questions (FAQs)

Q: What exactly are STCs? A: Small-scale Technology Certificates (STCs) are tradable credits that Australian property owners earn when installing an eligible solar system. They capture the renewable produced energy by your system and can be sold or credited to help offset installation costs.

Q: How does the STC Rebate in 2025 lower solar installation costs? A: The solar rebate is obtained by selling the Small-scale Technology Certificates (STCs) earned by Australian property owners to solar energy retailers or other liable entities. The revenue generated from these sales is applied as a discount on your solar panel installation, making the investment more affordable.

Q: Who can benefit from the STC Rebate 2025? A: The homeowners and small businesses across Australia who invest in solar systems installations can benefit from the Small-Scale Technology Certificate (STC) Rebate 2025, enjoying lower upfront costs, long-term energy savings and faster payback periods.

Q: Is my location important when earning STCs? A: Yes, Your locations with higher solar exposure, such as many areas in Australia, can generate more STCs. This is because greater energy output leads to a higher rebate value.

In Summary

The Small-Scale Technology Certificate (STC) Rebate in 2025 is a powerful solar incentive that plays a crucial role in making solar energy affordable and accessible for Australians. By reducing the upfront cost of solar systems installation and offering long-term savings on energy bills, the Small-Scale Technology Certificate (STC) Rebate 2025 helps you take a significant step toward energy independence and environmental sustainability.

As the STC rebate gradually reduces over time, 2025 is an ideal year to install a solar system and maximize your financial benefits. The sooner you invest in solar, the more STCs you can claim before the scheme phases out.

Explore your options today, consult with a reputable solar provider, and start benefiting from the financial and environmental rewards of renewable energy. Embrace the future with solar power and contribute to Australia’s journey toward a sustainable, 100% renewable energy future.

Shah Tarek is a Solar Energy Consultant with 10 years experience in solar system design and solar consultancy field at Australia. He is now a Director, Operation & Consultancy Division at Aussie Solar Tech, a leading Australian solar retailer and installer. Here he is writing informative and engaging solar content that educates the community on the benefits of solar power. His work supports Aussie Solar Tech’s mission to promote sustainable energy solutions and foster a greener future for Australia.